BOV Bank's AI Journey with EBO

In an effort to streamline processes, reduce manual workload, improve response time and enhance overall customer experience, Bank of Valletta plc (BOV) partnered with EBO to find an innovative solution. As a result, EBO deployed its advanced AI technology to assist in the transformation of the bank’s service approach, increase scalability, automate processes and align with today's digital demands.

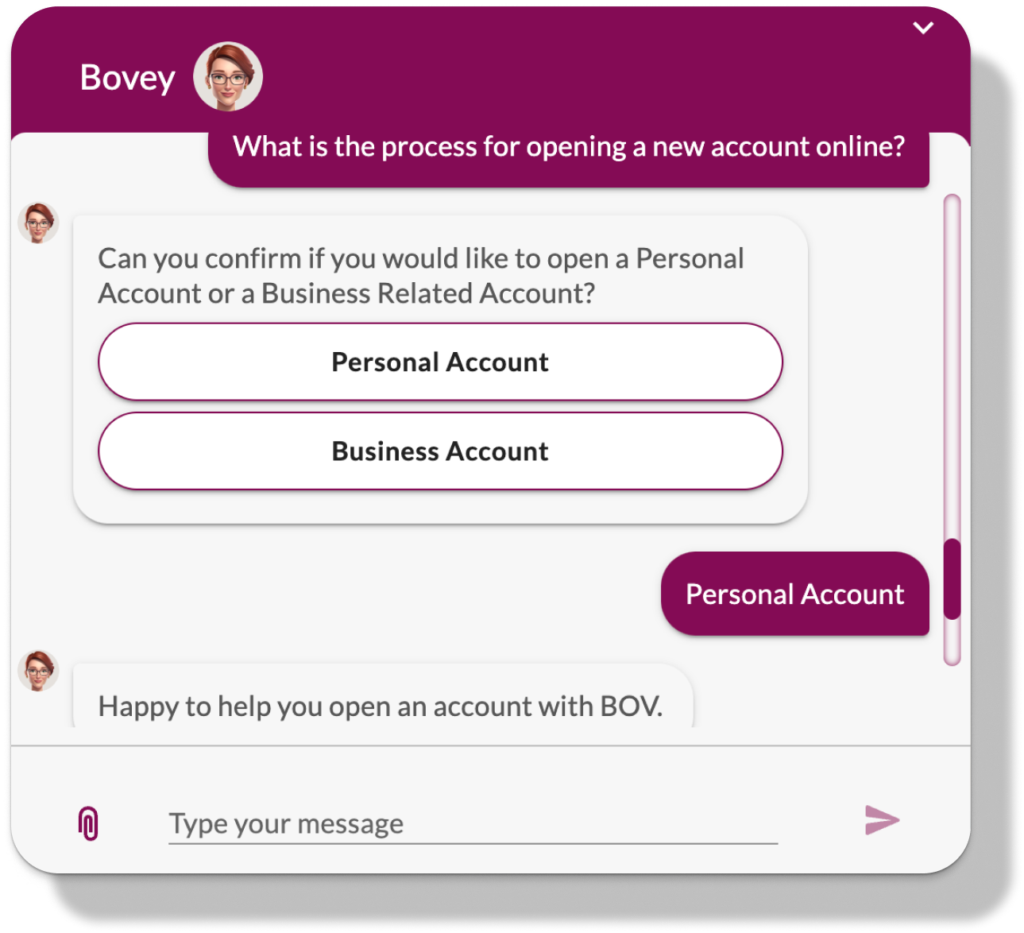

At the heart of this solution is Bovey, an AI Virtual Agent that enhances customer interactions, streamlines lead qualifications, and efficiently captures customer data.

Learn how EBO and BOV are setting new standards in customer engagement through the power of AI.

Bank of Valletta’s story

Bank of Valletta p.l.c. (BOV) is a leading banking institution in Malta, serving both individual and business clients through a network of 44 branches, an International Corporate Centre, Business Centres, Investment Centres, and a Wealth Management division. BOV provides a wide range of financial services tailored to meet diverse client needs.

What Goals Did BOV Have?

Tailored responses and personalised recommendations to boost satisfaction and loyalty.

Implement streamlined processes and systems to reduce manual workload, improve response times, and minimise customer wait periods, ensuring a seamless experience for clients.

Handling and protection of client data, maintaining confidentiality and complying with regulatory standards.

The Challenge

Before integrating EBO’s Artificial Intelligence (AI) into its customer support system, BOV wanted to address a number of operational challenges, common to contact centres. These included wait times, scalability issues, high workloads, staff turnover, and budget considerations, which resulted in potential missed opportunities and gaps in customer experience expectations.

Current-day customers expect BOV to leverage emerging technologies to provide immediate customer service on channels that are easily available and convenient. To address these challenges, EBO presented an AI-powered solution that adapts to evolving customer needs and preferences.

Results Speak Volumes

0%

of all chats handled autonomously by Bovey

0%

of operational goals [e.g. loan enqueries, card enqueries and appointment management] completed by Bovey

0%

customer satisfaction rate

The Solution

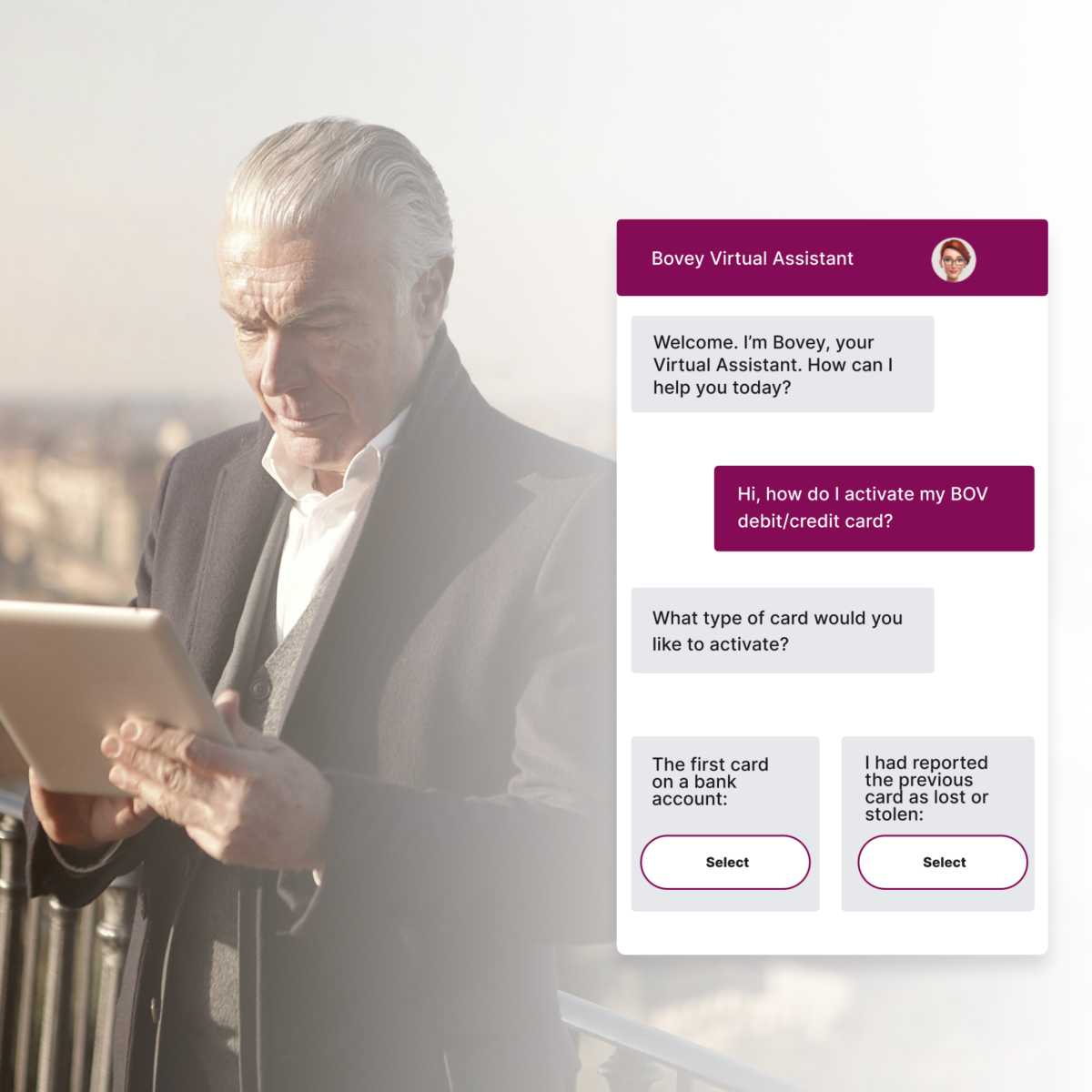

Meet Bovey, the Virtual Agent (VA) designed to automate BOV’s customer queries. One of the initiatives taken to enhance customer service was the introduction of Bovey. Today, the VA is seamlessly integrated into the BOV's website, providing instant responses to customer inquiries round-the-clock. Additionally, Bovey can handle incoming queries through ![Facebook Messenger]() Facebook Messenger, extending its accessibility and convenience across platforms.

Facebook Messenger, extending its accessibility and convenience across platforms.

To enhance its effectiveness, EBO’s NLP engineers trained Bovey using past customer interactions and then fine-tuned the language model based on actual dialogues managed within the solution. As Bovey engages with more customers, its machine-learning capabilities enable continuous self-improvement. This allows it to update its language processing skills and expand its ability to handle diverse and complex tasks.

Functionality & Capabilities

Bovey’s capabilities include:

Context Awareness and Sentiment Analysis

Bovey can understand the context and sentiment of customer queries, providing personalised responses, relevant to the conversation regardless of nuances or context change.

Advanced Query Escalation

Bovey has an escalation capability that recognises complex or high-value customer interactions and intelligently directs these to live agents when necessary. This ensures that critical queries receive immediate attention and maintains a high standard of customer care.

Enhanced Compliance and Data Security

Bovey adheres to strict data protection protocols, ensuring compliance with banking regulations and safeguarding sensitive customer information. This includes automated data handling processes that minimise human intervention, reducing the risk of breaches and supporting BOV’s regulatory obligations.

Advanced Multi-Channel Support

Bovey supports Facebook Messenger and website enquiries and soon will also available from the BOV native App in iOS and Android. This expanded accessibility meets customers where they are most active, furthering convenience and engagement.

Comprehensive Service

Bovey handles a wide range of tasks from booking appointments to opening loans, managing technical queries, and maintaining client records.

Automated Customer Feedback Collection

Bovey can request and collect feedback post-interaction, providing real-time insights into customer satisfaction. This ongoing feedback loop allows BOV to continuously refine customer interactions and improve service quality.

Customer Analytics

The backend interface provides BOV staff with extensive intelligence data built on Microsoft Power BI, eliminating the need for bespoke Business Intelligence software. This deeper understanding of customer interactions enables informed decision-making and strategic planning.

Streamlined Lead Qualification

Bovey efficiently captures necessary data from customers, and channels them to the appropriate service channels. This optimises resource allocation and enhances operational efficacy.

Around-the-Clock Support

Bovey automates routine tasks and provides instantaneous support, reducing wait times and enhancing customer satisfaction. This allows the bank to capture leads and provide a service beyond conventional business hours, freeing staff to focus on more complex tasks.

Discover the AI-powered platform by EBO

The Results

In six months, Bovey handled just under 18,000 customer conversations, covering technical support, card queries, account openings, appointment scheduling, and loan applications. This substantial workload reduction freed staff to address more complex tasks. With advanced NLP and Machine Learning, Bovey achieved a 92% accuracy in recognising customer inquiries. Additionally, customer satisfaction with Bovey’s service reached a remarkable 90%, reflecting the positive impact of its efficiency and responsiveness.

Through the implementation of Bovey, BOV has significantly improved customer experience, operational efficiency, and staff productivity. This AI-powered solution ensures that customer interactions are smoother, services are delivered more efficiently, and it establishes a strong foundation for future innovations, scalability, and growth in the ever-evolving financial services sector.